Let Snowball Equity be your guide on the path to stress-free, passive capital growth through real estate investment.

We apply our process to provide attractive investment opportunities to passive investors.

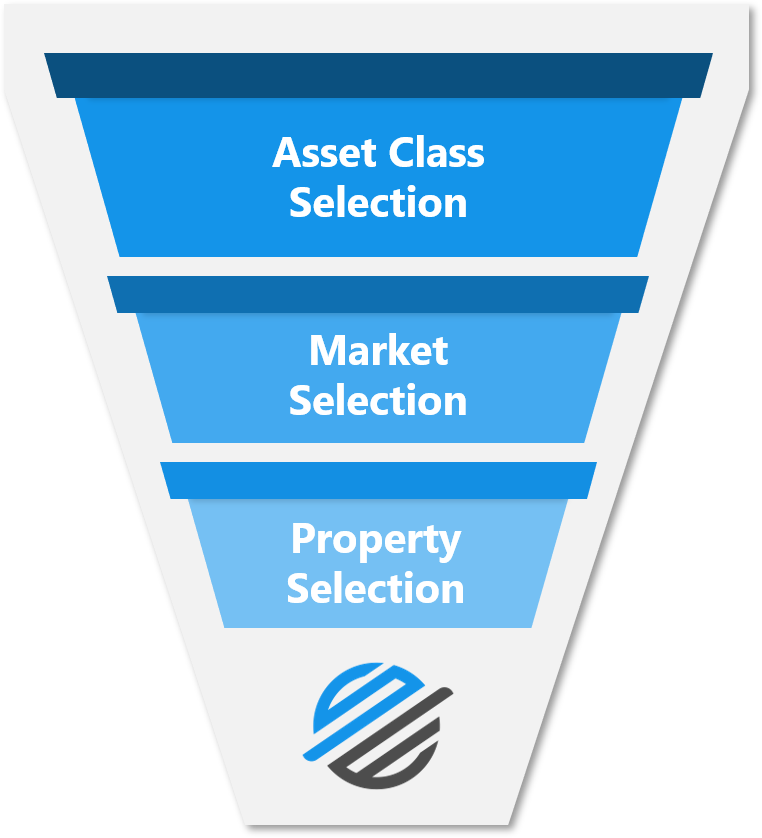

The Snowball Process

Asset Class Selection

Asset Class Selection

Using macro economic indicators, we identify selective multi-family residential properties as the preferred asset class for recession resistant returns.

Market and Sub-Market Selection

Market and Sub-Market Selection

Emphasizing the pivotal market and sub-market drivers of migration patterns, population growth and job growth, we concentrate efforts in markets with the right ingredients for success.

Property Selection

Property Selection

Our thorough review of property conditions and intimate knowledge of market tastes allow us to identify the best value-add opportunities.

Asset Selection Criteria

Properly selected multi-family is recession resistant.

Better performance during economic downturns while maximizing opportunity in times of plenty - this is how the Snowball process optimizes investments. Our team reviews hundreds of deals to locate the best opportunities in the market. Our superior understanding of the asset class, stringent underwriting process, and proven method for identifying low-risk investments with value-add potential, ensures that we preserve your capital while maximizing returns.

Market and Sub-Market Selection Criteria

We leverage a data-driven process to identify markets, sub-markets, and specific neighborhoods that are in the path of progress.

Beginning with our key indicators, we perform comprehensive analyses to identify the ideal locales for multi-family investments. Based on fundamental data, our selection criteria hedges against market volatility and produces stable returns.

Primary Indicators

Employment Growth

Employment Growth

Markets and submarkets that have an increasing number of high-paying jobs indicate stability in the tenant base through corollary growth that comes with those jobs.

Population Growth

Population Growth

We look for metros that have an uptrend in population growth over the last 5-10 years, suggesting a growing local economy.

Rent Growth & Vacancy

Rent Growth & Vacancy

We look at the 5-year rent growth forecast, including the overall market vacancy across the multifamily properties in the MSA.

Secondary Indicators

Job Diversity

Job Diversity

We look for diversity in employment and sectors serviced, to avoid overreliance on any one type of industry.

Sales Trend

Sales Trend

We monitor local sales trends to update our cap rates and fine-tune our projections.

Affordability

Affordability

We assess the affordability parameters of the metro compared to the national averages.

Property Selection Criteria

Under Performance

Under Performance

We identify problematic issues, such as under-performing staff, ineffective marketing, and poor curb appeal, which can be addressed through our customized business plans.

Local Growth Drivers

Local Growth Drivers

We invest in properties located in the path of progress and in areas poised to benefit from surrounding sub-market indicators, such as strong job growth and an influx of new enterprises.

Upside Potential

Upside Potential

Only a small percentage of properties we underwrite meet our strict buying criteria. Unrealized value and local drivers must combine with additional factors to maximize upside potential.

At Snowball Equity, we are committed to enhancing and improving the lives of our tenants by delivering quality and affordable rental housing.

"Most people overestimate what they can achieve in a year and underestimate what they can achieve in a decade"

Bill Gates

Co-founder of Microsoft

Our 5 Step Process

Every asset acquired by Snowball Equity goes through five steps, from identification and acquisition to the eventual disposition / refinance of the asset.

Identify

Identify

Identify high-quality assets with significant upside and a favorable risk to reward ratio that meets our very strict criteria.

Acquire

Acquire

Our team negotiates the purchase agreement, structures the deal, arranges optimal financing and handles closing.

Value-Add

Value-Add

We harness unrealized value in the property through our value-add strategy, which leads to premium valuation and increased cash-flow for our investors.

Optimize

Optimize

We apply effective management to improve occupancy and retain the best tenants, driving up our Net Operating Income (NOI).

Exit

Exit

We constantly monitor the property and market for the best exit - either a timely sale or strategic refinance - to return our investors' capital and more.

Why passive real estate is the IDEAL investment?

At Snowball Equity, we truly believe that real estate offers superior risk-adjusted returns over other asset classes due to 5 key aspects of wealth creation:

Income

Income

Positive cash flow from operations is distributed to investors in accordance with the business plan, typically on a quarterly basis.

Depreciation

Depreciation

Investors enjoy the tax benefits of ordinary depreciation and accelerated depreciation through cost segregation.

Equity Growth

Equity Growth

Operating income is used to pay down debt (amortization), leading to substantial growth in investors' equity in the property over time.

Appreciation

Appreciation

Multi-family benefits from forced appreciation through the increase of Net Operating Income (NOI), as well as from natural, market-wide appreciation.

Leverage

Leverage

Responsible leverage is a tool that increases buying power and maximizes the return on investment for investors.

Ready to learn more ?

Interested in learning more about Snowball Equity and how the process works in order for you to partner with us on future investment opportunities?