Reimagining the way money flows through the world

Our mission is to provide our clients with the most comprehensive data, the most valuable insights and the most powerful analytical tools in the global FinTech industry, in order to enable them to make superior business decisions.

Working with market leaders in the FinTech industry

We provide the most comprehensive source of information on FinTech

in the marketplace, combined with powerful analytical tools

Investor Search

Investor Search

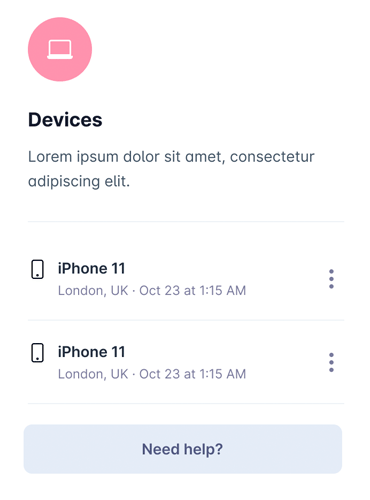

It encompasses developing apps for phones, tablets, smart watches, and all other kinds of wearable devices.

Fintech Consulting

Fintech Consulting

It encompasses developing apps for phones, tablets, smart watches, and all other kinds of wearable devices.

Finance Platform

Finance Platform

It encompasses developing apps for phones, tablets, smart watches, and all other kinds of wearable devices.

Quality Assurance

Quality Assurance

It encompasses developing apps for phones, tablets, smart watches, and all other kinds of wearable devices.

Focused Research

Focused Research

It encompasses developing apps for phones, tablets, smart watches, and all other kinds of wearable devices.

Data Verification

Data Verification

It encompasses developing apps for phones, tablets, smart watches, and all other kinds of wearable devices.

Are you looking for more information or want to try one of our IT services?

If you need comprehensive strategies to adopt, implement, and manage technologies

critical for your business, we are the first step towards success

Identify active investors and new prospective investors

Companies and financial institutions

Companies and financial institutions

Find and track the connections between FinTech companies and investors for any sector

The fintech global advantage

The fintech global advantage

Find and track the connections between FinTech companies and investors for any sector

Work on big ideas, without the busywork

Case studies - SilverTech’s IT success stories

August 15, 2021. 5:00 PMReal Estate Education

Real Estate Syndication – What is it?

Real estate syndication is when a group of investors pool their capital and other resources to invest in real estate assets. Typically, there are two broad groups: the passive investors, often called the limited partners or LPs, and the sponsors, often called the general partners, GPs or syndicators.

August 15, 2021. 5:57 AMReal Estate Education

Investing: Real Estate vs. Stocks

This is a never-ending debate. We provide a perspective on what separates real estate from stocks. We have made it clear that a large part of our portfolio and investment strategy is focused on real estate, but that does not mean that one should not be simultaneously be investing in the stock portfolio.

July 19, 2021. 5:46 AMReal Estate Education

Single Family v. Multifamily Investment

When most people think about real estate, they probably picture a detached, single-family house. But that’s far from the only option available for investors to invest in today’s housing market. Multi-family investments are homes with several units, offering another avenue for investors to purchase more than one unit.

April 15, 2021. 1:51 AMReal Estate Education

What is Cost Segregation and Why it Makes Sense?

Cost segregation provides real estate investors a method to accelerate depreciation. It is a valuable strategic tax planning tool that overall separates real property into various depreciable categories, and allows taxpayers to depreciate property over much shorter periods of time than the typical 39-year period.

February 19, 2021. 1:58 PMReal Estate Education

Reasons to have Commercial Real Estate part of your Portfolio

Over the past 25-years until 2017, multifamily real estate provided the highest average annual total returns of any commercial real estate sector with the second lowest level of volatility, according to CBRE. We provide a perspective on the reasons why commercial real estate should be part of everyone's portfolio.

October 7, 2020. 1:59 PMReal Estate Education

Overseas Multifamily Investors – What should you know?

Overall, the United States remains a fundamentally attractive real estate market, fueled by the pandemic driven real estate growth. The low interest rates, favorable tax rules, a stable U.S. economy, and the overall liquidity and transparency of the domestic real estate market have contributed to an acceleration of real estate activity – including record amounts of foreign investment.

We empower clients to grow their businesses based on the effective use of technology

We can evaluate, design and execute the right technology strategies that will help

your business operate at peak performance.

Your information is 100% secure. We don’t do spam!